With decentralized virtual currencies like Bitcoin growing in usage and adoption, the potential for fraudulent imitation or counterfeiting has unfortunately also increased in the online realm.

Whether one is a seasoned investor or a newcomer to the cryptocurrency sphere, discerning genuine units from forgeries in the digital domain is a prudent and necessary diligence.

Keep in mind that investing should be done only on well-known and reliable platforms. If you are looking for one, just click here. This article aims to provide insight into key signs and indicators the average person can evaluate to ascertain whether a given bitcoin or any such intangible currency, is authentic as claimed when transacting online.

Table of Contents

ToggleMore About the Authenticity

Bitcoin is still a new concept for many, existing primarily in the digital world. Yet some have tried to make this intangible currency more relatable by creating physical tokens that represent Bitcoin’s value. From the curiosity of tinkerers came “Casascius coins”, which are solid metal discs that contain a secret link to digital coins they can be redeemed for online.

However, with any new innovation comes the risk of deception. As Bitcoin gains popularity, so too do those who would take advantage of the unwary.

Both the digital Bitcoin ecosystem and tangible tokens must be scrutinized to ensure legitimacy. It is understandable that people desire assurance their money is real and secure, whether kept as code or carried as a coin.

Blockchain Verification

The blockchain acts as a kind of communal notebook where all Bitcoin transactions are publicly recorded. It allows anyone to carefully check a transaction’s origin by following the digital breadcrumbs. With patience and an open manner, one can validate a Bitcoin’s authenticity through the blockchain process.

First, the Bitcoin address associated with the transfer is gently obtained. Online forums like Blockchain.info then allow free viewing an address’s history without judgment. Examining details like amount and date aims simply to ensure reality matches expectations – not to accuse or condemn.

Transaction confirmation by the network brings further reassurance. When funds travel, volunteer helpers called “miners” attentively validate the movement before adding to the shared ledger. Multiple confirmations build trust over time like repeated acts of honesty strengthen bonds between people.

Physical Bitcoins as Treasured Reminders

These novelty coins hold meaning as collectibles and tangible tributes to the digital currency’s spirit of sharing. Their authenticity brings peace through features examined with patience and goodwill.

A holographic image, like a seal of trust between friends, veils the private way to assess value if one day it’s needed. With care not to damage, its tamper-proof nature preserves the bond over time.

A special number too connects each coin to its rightful history through a manufacturer’s page made open for truth, not traps. Entering allows respecting each contributor’s story, as names might in a cherished book of memories.

Additional Verification Methods

Technical features like private keys, signatures, and blockchain records all have reasonable verification purposes when properly implemented and contextualized. At their best, they balance the need for transparency with appropriate privacy and consent.

However, without responsible guidance, new users could misinterpret details in an emotionally charged way that breeds unwarranted suspicion or fear.

Be Sure to Get the Right Wallet

When getting involved with cryptocurrency, it’s important to take basic security precautions to protect your money and your personal information. Where you download wallet software from and how you verify transactions matters.

Official wallet sites are usually your best bet over random downloads. That way you know the software is legitimate and wasn’t tampered with. Most developers provide hash codes you can use to cross-check files.

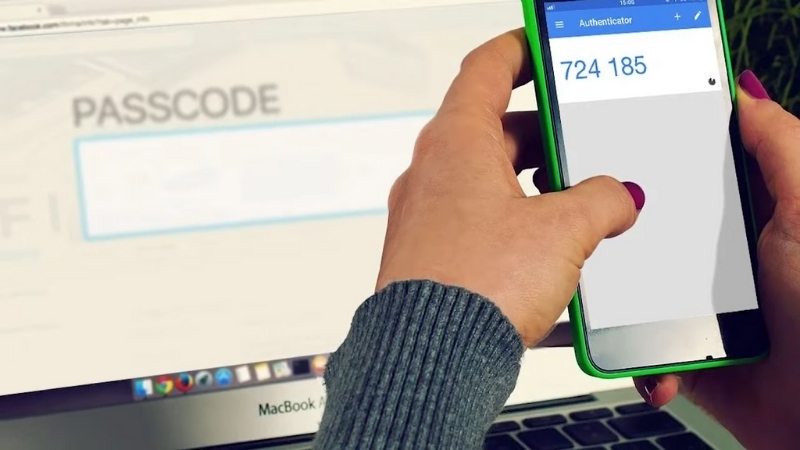

Going with well-known wallets also means the software has proper security features built in, like two-factor authentication and multisig approval requirements. Those extra verification layers add protection without being a hassle.

As for verifying transactions, the blockchain is a transparent public record so you can trace funds back to their source. Following transactions from wallet addresses confirms their validity. Just be careful not to fall for scams or copycat sites pretending to be something they’re not.

Use Hardware Wallets for Higher Protection

Those little encrypted devices are handy for protecting your cryptocurrency holdings. They take private keys completely offline, which prevents malware and hacking attempts from putting them at risk.

Your money stays secure because the sensitive key information never touches an internet-connected computer. The hardware wallet acts like a little signing station – transactions are confirmed on the physical device instead of online.

As long as you generate the original keys only on the hardware wallet itself and never input them anywhere else, your funds will remain safely tucked away. Even if your regular computer or phone gets compromised somehow, offline storage means nothing can happen to your crypto.

Going the hardware route removes one of the major security concerns inherent in crypto since online exchange attacks and viruses can’t put your private keys in danger.

Endnote

Now that you understand the core aspects of verifying transactions, using reputable wallets, and storing funds on hardware devices, you’ve got the basics covered to confidently get into cryptocurrency.

Taking some simple precautions like checking addresses, confirming transaction histories on public ledgers, and downloading only from the source helps ensure your Bitcoin is legit. Enabling multi-step wallet security features and putting private keys beyond hackers’ reach with hardware storage massively improves protection too.

Watch out for phishing sites trying to steal login details and “get rich quick” schemes promising returns that sound too good to be true. Stick to trusted exchanges, read up on new projects thoroughly before investing, and you’ll avoid getting scammed.