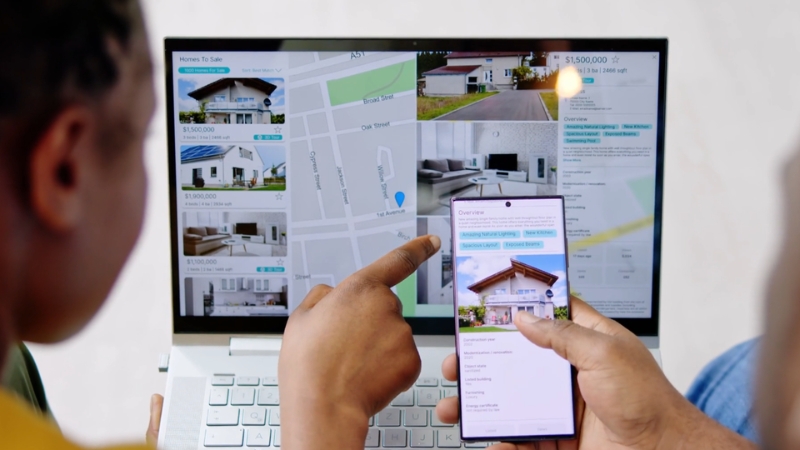

Finding properties below market price is a cornerstone strategy for real estate investors who aim to build equity rapidly while reducing upfront costs.

In 2025’s market, where interest rates and global uncertainties have created pockets of motivated sellers, savvy investors can still find unique opportunities—if they know where to look and how to evaluate risk versus reward.

Buying a property under market value means you are instantly gaining equity, providing a cushion for renovations, a stronger position during refinancing, or better profitability upon resale.

Research from the National Association of Realtors indicates that properties purchased at 10-20% below market price can yield 12-18% higher ROI over a five-year holding period compared to properties bought at market rates, especially when value-add renovations are implemented.

4 Best Channels to Find Below-Market Price Properties

1. Distressed Properties and Foreclosures

Distressed properties, including those in pre-foreclosure or foreclosure, often present some of the best opportunities for purchasing real estate below market value. In these situations, homeowners are unable to keep up with mortgage payments, prompting lenders to reclaim and sell the property to recoup losses.

Banks and lenders typically prefer a quick sale over managing the property themselves, leading to pricing flexibility that investors can leverage during negotiations.

For example, a 2024 report found that foreclosure properties in Florida sold for an average of 16% below market value, immediately providing investors with a cushion of equity that can be used for renovations, refinancing, or flipping for profit.

These deals often move quickly, so investors prepared with financing and due diligence processes can secure properties before competitors enter the picture.

2. Off-Market Deals

Off-market deals, or “pocket listings,” are properties that are available for sale but not publicly advertised on MLS or property listing websites. These properties often become available through quiet negotiations due to the seller’s desire for privacy, the need for a quick transaction, or to avoid market speculation driving down perceived value.

Accessing off-market deals requires proactive networking and relationship building. Strategies include connecting with local agents and wholesalers who often have early insight into upcoming sales, using direct mail campaigns targeted to absentee owners who may wish to offload underutilized properties, and monitoring property tax delinquency lists, which often indicate a motivated seller.

Investors working with a trusted real estate agency in Dubai, New York, or London frequently gain access to curated lists of off-market properties, including luxury apartments, off-plan units, and development plots that may not be available to the general public.

This advantage allows investors to secure properties in prime locations at prices below market, with less competition and the flexibility to negotiate favorable terms.

3. Auctions

Real estate auctions, whether conducted in person or online, offer another effective avenue for finding below-market properties. Properties enter auction for various reasons, including foreclosure proceedings, tax lien sales, or court-ordered settlements.

Auctions often allow buyers to secure properties at 10-30% below current market prices, though the exact discount varies based on local demand, the condition of the property, and auction competition.

It is crucial to perform thorough due diligence before participating in an auction, as properties are typically sold “as is.” Investors should investigate liens, title issues, and the physical state of the property to avoid unexpected repair costs that could erode potential profits.

Despite the risks, auctions can be a fast track to acquiring under-market properties in both residential and commercial sectors, providing opportunities for immediate value creation through renovation and repositioning.

4. Divorce and Estate Sales

Properties involved in divorce proceedings or inherited estates are often priced to sell quickly due to time-sensitive legal and financial motivations of the parties involved. Divorcing couples may prioritize liquidating joint assets, while heirs may prefer to sell inherited properties quickly rather than manage, maintain, or co-own the asset with siblings or relatives.

These transactions can create opportunities for investors to negotiate favorable pricing, flexible closing terms, and even seller financing arrangements, all of which enhance the profitability of the deal. Investors focusing on this channel should work with attorneys, probate specialists, and experienced agents who can identify and facilitate these transactions efficiently.

Markets Where Below-Market Opportunities Are Plentiful

While you can find under-market properties anywhere, certain locations in 2025 offer particularly fertile ground:

- Secondary Cities in the U.S. (Cleveland, Indianapolis, Birmingham) have high rental demand and low property taxes.

- Emerging European Markets (Lisbon outskirts, Bucharest), where economic growth is driving future appreciation.

- Dubai’s Residential Market, where fluctuations in expat movement and project oversupply can create motivated sellers.

Case Study: Opportunities in Dubai

Dubai’s real estate market has unique cycles influenced by global migration, regional economic trends, and regulatory shifts. According to a 2024 JLL report, Dubai saw a 7% average price dip in specific mid-tier apartment sectors, while luxury beachfront properties maintained stable or rising prices.

Working with a real estate agency in Dubai can give investors insider access to:

Additionally, Dubai offers strong rental yields (averaging 5-8% depending on location), and with no property taxes, under-market acquisitions can transform into high-yield rental investments with attractive cash flow.

Strategies for Investors

Perform Detailed Market Analysis

Success in acquiring below-market properties begins with understanding true market value in your target area. Use tools like PropStream, Mashvisor, or local MLS data to analyze recent sale prices, average days on market, and trends across comparable properties.

This approach allows you to identify genuine undervalued opportunities rather than properties that appear cheap but align with local market realities due to location or condition issues. Accurate market analysis ensures you only pursue deals with a clear margin for profit, whether your goal is flipping or long-term rental income.

Work with Specialized Agents

Partnering with professionals makes a significant difference in sourcing below-market deals. A real estate agency in Dubai or your target market often has inside knowledge of upcoming distressed sales, off-market listings, and motivated sellers not publicly advertising their properties.

These agencies can align listings with your investment criteria, provide comparative market data, and streamline negotiations while helping you avoid properties with legal or zoning complications, which are particularly important in international or heavily regulated markets.

Be Prepared to Move Quickly

Properties priced below market attract investor competition, requiring swift action. Have financing pre-approved, funds accessible, and your legal team ready to conduct due diligence without delay.

The ability to act decisively can often be the difference between securing a profitable deal and missing out to faster, prepared buyers. In hot markets, being ready can also provide leverage for negotiating a lower purchase price by demonstrating your ability to close quickly.

Factor in Renovation Potential

Many under-market properties require updates, from cosmetic enhancements to significant structural repairs. Investors should budget realistically for renovation costs to maximize post-renovation resale value (ARV) or rental potential.

Consulting with contractors for accurate estimates before purchase is critical, as underestimating renovation costs can erode expected profit margins. Factor in additional costs for permits, inspections, and potential delays when assessing each property’s investment potential.

Negotiate Creatively

Negotiation extends beyond the purchase price. Consider negotiating for the seller to cover part of the closing costs, request flexible move-out dates to reduce vacancy risk, or explore seller financing options that reduce your upfront capital requirement.

Creative terms can enhance cash-on-cash returns and reduce holding costs, improving overall deal profitability.

Risks and Considerations

@koveproperties So many people chase below market value properties, yet they forget why it’s below market value in the first place. It’s in low-income areas with lower social grade tenants — meaning higher voids and maintenance, and a higher risk of rent arrears. They buy in areas in the middle of nowhere, with low infrastructure and job prospects — meaning low capital growth. If you buy a property in these areas, yeah, you make some money in the short term, but you take on risk, headaches, and build wealth slowly in the long term. It’s counterproductive. If you want to invest in property and live life on your own terms, why not click the link in our bio? Choose ‘I want to invest’ for a hands-off investment solution to property investing! Operating in the United Kingdom. If you’re not following us already make sure you follow @koveproperties for the best tips and tricks, money and property content! Returns are not guaranteed and depend on market conditions, property performance, and other factors. This is for informational purposes only and does not constitute financial advice. Past performance does not indicate future results. #ukpropertymarket #ukproperty #ukpropertyinvestment ♬ original sound – Daniel Duffield

While buying below market value offers attractive upside, investors should be aware of potential risks that can impact the profitability and ease of acquisition:

- Hidden Structural or Title Issues: Distressed properties may have underlying damage or legal complications requiring costly resolutions.

- High Competition: Bidding wars can erode the discount, particularly in competitive markets.

- Overestimating ARV: Misjudging post-renovation resale or rental value can lead to lower-than-expected returns.

To mitigate these risks, always conduct thorough property inspections, perform title searches, and partner with trusted professionals for renovation assessments and legal clearances, especially when investing in complex markets such as Dubai.

Conclusion

Investing in below-market properties remains one of the most effective strategies for building wealth in real estate, allowing investors to secure instant equity and maximize long-term returns.

By leveraging detailed market analysis, partnering with specialized agents, moving quickly on opportunities, and factoring in renovation potential, you position yourself to capitalize on properties others may overlook.

Equally important is recognizing and managing the risks that come with these deals. Success in this space requires a balance of decisiveness and caution, a clear financial strategy, and a willingness to engage in creative negotiation to unlock the full potential of each property.