Wealth-building requires patience, consistency, and smart decision-making.

Starting with small investments and aligning them with personal financial goals sets the foundation.

Over time, disciplined contributions can lead to meaningful growth.

Table of Contents

Toggle1. Stock Market Investments

Stock market investing offers a straightforward way to begin building wealth. With options ranging from individual company shares to index funds that follow broader market benchmarks like the S&P 500, investors can choose strategies based on their goals and comfort levels.

Dollar-cost averaging—investing a fixed amount at regular intervals—helps smooth out price fluctuations and removes the pressure of trying to time the market.

Starting with even modest amounts and maintaining discipline can lead to significant gains in the long run.

2. Cryptocurrencies

Cryptocurrencies offer high-growth potential and continue to attract attention from investors across experience levels. Digital assets like Bitcoin, Ethereum, and others serve as speculative tools and potential long-term holdings.

Allocating a small portion of a portfolio to crypto allows investors to pursue a high upside while managing overall exposure. Due to sharp market swings, only disposable capital should be used in this space.

Platforms such as BYDFI are now considered a trusted alternative for perpetual contracts, providing access to decentralized finance with less reliance on traditional intermediaries.

Security remains critical in the crypto world. Leaving funds on exchanges can increase risk, so offline storage is often recommended.

Key points:

Best practices:

3. Real Estate

Part 3: Exploring REITS (Real Estate Investment Trusts)

Yesterday I shared about the mechanics of Trusts, how they protect collective funds, and how the value of these funds is determined. I have received quite encouraging feedback from readers and some of them have asked me to…

— Livingstone Mukasa (@MukasaMulya) September 11, 2024

Real estate provides physical ownership and the potential for steady, long-term income.

Property investments can include rental houses, duplexes, or larger multifamily complexes.

For those without large amounts of capital, entry is possible through Real Estate Investment Trusts (REITs) or fractional property platforms.

Benefits include:

Many investors use real estate to generate passive income while building equity.

Smaller real estate platforms now enable participation with lower upfront amounts, making investment accessible to more people.

Options worth considering:

Real estate works well for those seeking both income and long-term growth potential.

4. Retirement Accounts (401(k), IRA)

Retirement accounts offer long-term saving tools with tax advantages.

A 401(k) is commonly available through employers and often includes matching contributions.

Individual Retirement Accounts (IRAs) offer flexibility for self-directed contributions and broader investment choices.

Key benefits include:

Contributing at least enough to receive the full employer match is essential. Ignoring that opportunity means missing out on money that could build value over time.

Starting early helps maximize growth potential. Regular contributions—even in small amounts, can result in substantial balances after decades of disciplined saving.

Retirement planning becomes more manageable when built on consistent habits and early action.

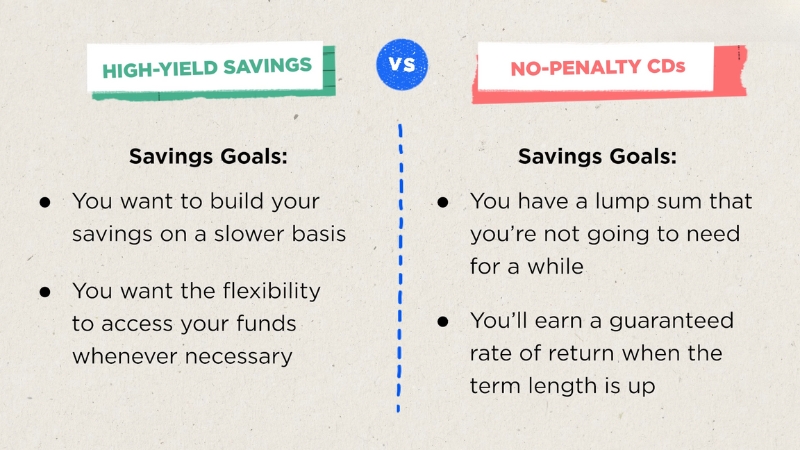

5. High-Yield Savings Accounts and CDs

High-yield savings accounts and certificates of deposit (CDs) provide secure ways to grow money with minimal risk.

Conservative investors often use these options to preserve capital while earning steady interest.

Ideal for emergency funds or short-term financial goals, these accounts offer peace of mind with predictable returns.

Unlike market-driven investments, funds in savings accounts and CDs aren’t subject to volatility.

Key benefits include:

Online banks typically offer more competitive interest rates than traditional brick-and-mortar institutions.

Choosing an FDIC-insured option ensures deposits are protected up to the allowed limit, adding another layer of financial security.

6. Bonds (Government and Corporate)

@nasdaily I studied money for 5 months. And found one of the safest ways to invest it. @etoro_official ♬ original sound – Nas Daily

Bonds offer a dependable way to generate income with lower exposure to risk.

Government bonds are backed by federal institutions, while corporate bonds provide slightly higher returns in exchange for additional risk.

Predictable interest payments and maturity values make bonds suitable for those prioritizing stability. They also serve as a counterbalance to stock-heavy portfolios.

Key benefits of investing in bonds:

Laddering bonds, buying them with staggered maturity dates, can help reduce exposure to changing interest rates.

Investors with a conservative outlook often find value in consistent returns and reduced stress during market downturns.

7. Mutual Funds & ETFs

Mutual funds and ETFs give investors access to a wide range of assets without the hassle of managing individual stocks or bonds.

They serve as convenient tools for spreading risk and building a balanced portfolio.

Both options:

Many investors use these funds as the foundation of their long-term strategy.

With automatic contributions and reinvested dividends, growth can compound steadily over time.

8. Alternative Investments (e.g., Hard Money Loans, Crowdfunding Platforms)

Platforms focused on real estate crowdfunding or peer-to-peer lending give everyday investors access to projects once limited to institutions or the wealthy.

Potential benefits include:

Risks can be significant, especially when lending to individuals or startups without a proven track record. Careful evaluation of:

Allocating a small portion of an overall portfolio to these investments can enhance return potential.

With proper research and a cautious approach, alternative assets may provide steady returns while complementing more conventional strategies.

9. Education and Skills Development

Gaining new skills, earning certifications, or completing advanced degrees can open doors to higher-paying roles and long-term career growth.

Technical skills are in especially high demand and can be learned through online courses or part-time programs:

Soft skills often have just as much influence on career progression:

Personal growth fuels confidence, adaptability, and higher income over time. Learning should remain a lifelong habit, not a one-time event.

Small, consistent steps in education can lead to substantial financial rewards.

10. Insurance and Asset Protection

View this post on Instagram

A post shared by Michael Tarro Jr. | Business Lawyer | Estate Planning (@michaeltarrojr)

Insurance helps protect accumulated wealth by covering unexpected events that could lead to financial setbacks. Having the right policies in place reduces personal risk and safeguards long-term financial plans.

Essential coverage types include:

Tailored policies provide security by matching specific lifestyle and asset protection needs. For example:

- Renters insurance can cover theft, fire damage, or liability at a minimal cost

- Auto insurance ensures protection during accidents or property damage claims

Certain life insurance options, such as whole or universal policies, may include an investment element:

- Accumulates cash value over time

- Can supplement retirement savings or emergency funds

- May allow policyholders to borrow against the policy

Strong insurance planning reinforces overall wealth-building by protecting against losses that could erase years of progress.

The Bottom Line

Building wealth doesn’t require perfection; it demands:

Start small, diversify wisely, and keep your investments aligned with your personal goals.

Stay disciplined through market ups and downs, and don’t hesitate to seek guidance from financial professionals. Long-term wealth grows best through informed, consistent action.