Running an Etsy shop in the United States is not just about crafting great products; it is also about meeting each state’s legal and tax requirements.

Whether you sell handmade jewelry, digital prints, or vintage items, nearly every state requires some level of business registration or permit.

The specific rules depend on where you operate and how much you earn, but the underlying principle is the same: if you are making consistent sales with the intent to profit, your shop is a business in the eyes of the law.

Table of Contents

ToggleWhen an Etsy Shop Becomes a Business

An Etsy shop usually qualifies as a business once it generates ongoing revenue, regardless of scale. Even if it starts as a hobby, consistent transactions or marketing efforts indicate commercial intent.

At that point, you are typically required to:

This applies across all 50 states, though the paperwork and costs vary widely.

Federal vs. State Responsibilities

At the federal level, you’ll need an Employer Identification Number (EIN) if you hire staff or form an LLC. Etsy automatically collects and remits sales tax in many states, but you’re still responsible for state-level compliance.

At the state level, your responsibilities may include:

Requirement

Purpose

Typical Cost

Renewal

Business Registration

Legal operation under your brand

$25–$200

Every 1–2 years

Sales Tax Permit

Enables you to collect sales tax

Free to $50

Usually none

Home Occupation Permit

For home-based businesses

$20–$100

Varies

Local Business License

Required by some cities/counties

$25–$150

Annually

Regional Differences in Etsy Business Rules

1. Western States

- California: Requires a Seller’s Permit from the California Department of Tax and Fee Administration (CDTFA). Many Etsy sellers also register a DBA (“Doing Business As”) if they operate under a shop name.

- Washington: Demands a state business license for anyone earning over $12,000 per year or operating as a formal business.

- Oregon: No statewide sales tax, but still requires registration through the Secretary of State for LLCs or sole proprietorships with employees.

- Nevada: Mandates a State Business License and a city permit for home-based sellers in most municipalities.

2. Midwest

- Illinois: Etsy sellers need a sales tax number from the Illinois Department of Revenue, even for online-only operations.

- Ohio: Requires a Vendor’s License and a business registration with the Secretary of State if you form an LLC.

- Michigan: Straightforward registration through the LARA website. Local home occupation permits may apply if you ship from your home.

- Minnesota: Sales tax permit needed for all sellers shipping to Minnesota customers, including digital products.

3. Southern States

- Texas: You must apply for a Sales and Use Tax Permit with the Texas Comptroller of Public Accounts. Texas also has strong local regulations, so city or county permits may apply.

- Florida: Requires both a state sales tax certificate and a local business tax receipt (formerly occupational license).

- Georgia: Home-based Etsy sellers must obtain a business license from their local county. Sales tax registration is done through the Georgia Tax Center.

- Louisiana: Known for complex parish-level taxes. Sellers often register both at the state and local parish level.

4. Northeastern States

- New York: Sellers need a Certificate of Authority to collect sales tax. NYC-based sellers must also follow city-specific home business zoning rules.

- Massachusetts: Requires a Sales and Use Tax Registration and possibly a home occupation permit.

- Pennsylvania: Every Etsy seller must hold a Sales Tax License. The state is strict about distinguishing hobbies from businesses.

- New Jersey: Straightforward online registration via the Division of Revenue and Enterprise Services.

5. Mountain and Plains States

- Colorado: Each Etsy seller must have a state sales tax license and may need separate city licenses due to “home rule” cities.

- Utah: Business registration through OneStop.Utah.gov and a Sales Tax License.

- Kansas: Requires all online sellers to collect and remit sales tax, even for small operations.

- Montana, Wyoming, and South Dakota: No statewide sales tax, but business registration is still required for legal operation and banking purposes.

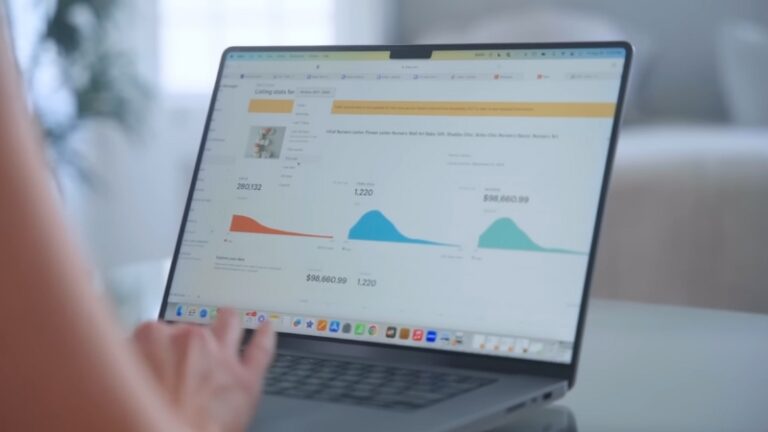

Since Etsy handles marketplace facilitator sales tax, you don’t usually have to calculate or remit sales tax manually.

However, some states still require Etsy sellers to register and file informational returns to confirm compliance. The rule of thumb: if your Etsy shop’s income exceeds $1,000–$2,000 in a state, check its Department of Revenue website.

When to Register as an LLC or Sole Proprietor

@christinamlazaro Replying to @Emily Thompson no you don’t need an LLC to sell on Etsy but let me give an explanation #etsyshop #etsyseller #etsysellertips ♬ original sound – Christina ✨

If your Etsy shop is growing, forming an LLC can protect your personal assets and give your shop legitimacy when applying for business credit or wholesale deals.

For small or experimental sellers, a sole proprietorship is simpler and cheaper. You can always upgrade to an LLC later once your revenue justifies the paperwork.

Business Type

Setup Cost

Annual Maintenance

Tax Filing

Liability

Sole Proprietorship

$0–$50

None

Personal return

Unlimited

LLC

$100–$500

$0–$200

Separate filing

Limited

Corporation

$300–$1,000

$100–$800

Corporate taxes

Limited

Licenses for Home-Based Etsy Shops

View this post on Instagram

A post shared by Bianca Davis ✨ONLINE BIZ FOR BEGINNERS✨ (@bianca_davis_official)

Many Etsy sellers operate straight from their living rooms or garages, but local governments often treat that setup as a “home occupation.” Most cities require a Home Occupation Permit to make sure your business fits residential zoning rules. That step becomes essential if:

When running an Etsy shop, having the right tools is essential for creating high-quality, personalized products. TOOCAA specializes in providing laser engravers, ideal for artisans and small business owners looking to offer custom engravings.

Their engravers are built to handle detailed designs, making them a great choice for those wanting to add a personal touch to products like gifts, home decor, or jewelry.

These machines are designed to support businesses at every stage of production, from small Etsy shops to growing enterprises.

50-State Overview Table

State

Registration Needed

Sales Tax

Local Permit Common?

Alabama

Yes

Yes

Sometimes

Alaska

Yes

No

Rare

Arizona

Yes

Yes

Yes

Arkansas

Yes

Yes

Yes

California

Yes

Yes

Yes

Colorado

Yes

Yes

Yes

Connecticut

Yes

Yes

Yes

Delaware

Yes

No

No

Florida

Yes

Yes

Yes

Georgia

Yes

Yes

Yes

Hawaii

Yes

Yes (General Excise)

Yes

Idaho

Yes

Yes

No

Illinois

Yes

Yes

Yes

Indiana

Yes

Yes

Sometimes

Iowa

Yes

Yes

Sometimes

Kansas

Yes

Yes

No

Kentucky

Yes

Yes

No

Louisiana

Yes

Yes

Yes

Maine

Yes

Yes

Sometimes

Maryland

Yes

Yes

Yes

Massachusetts

Yes

Yes

Yes

Michigan

Yes

Yes

Sometimes

Minnesota

Yes

Yes

Yes

Mississippi

Yes

Yes

Sometimes

Missouri

Yes

Yes

Sometimes

Montana

Yes

No

No

Nebraska

Yes

Yes

Yes

Nevada

Yes

Yes

Yes

New Hampshire

Yes

No

No

New Jersey

Yes

Yes

Yes

New Mexico

Yes

Yes (Gross Receipts)

Yes

New York

Yes

Yes

Yes

North Carolina

Yes

Yes

Yes

North Dakota

Yes

Yes

No

Ohio

Yes

Yes

Yes

Oklahoma

Yes

Yes

Yes

Oregon

Yes

No

No

Pennsylvania

Yes

Yes

Yes

Rhode Island

Yes

Yes

Yes

South Carolina

Yes

Yes

Yes

South Dakota

Yes

Yes

Sometimes

Tennessee

Yes

Yes

Yes

Texas

Yes

Yes

Yes

Utah

Yes

Yes

Yes

Vermont

Yes

Yes

Sometimes

Virginia

Yes

Yes

Yes

Washington

Yes

Yes

Yes

West Virginia

Yes

Yes

Sometimes

Wisconsin

Yes

Yes

Yes

Wyoming

Yes

No

Rare

Final Word

Etsy sellers often underestimate how state rules differ, but compliance builds long-term stability.

The key is to treat your Etsy store like a real business from day one, get your local registration, stay up to date with tax obligations, and maintain organized records.

The smoother your legal foundation, the more confidently you can grow your creative brand without fearing sudden fines or account restrictions.

Related Posts:

- Acadia National Park Camping Guide - Best…

- Confined Space Entry Rules That Protect Industrial Workers

- Drew Starkey Height, Age, Net Worth, Wife and All Biography

- Daylight Saving Time - Why Some States Follow It and…

- 5 Most Common Lizards Found in Florida - All You…

- John Abraham Hewson: All About Bono's Youngest Son Life