Nowadays, everyone and everything is optimized through card machines, and most payments are done online. Everything is cashless, and the right card machine is vital for small businesses aiming to thrive.

Whether you’re a boutique, a café, or a freelancer, selecting the best card machine can significantly enhance customer experience and streamline operations, no matter where you may be in the world, and no matter the job that you’re doing.

However, how to pick out the best one that works for you? Since there are numerous options available, making the right choice can be overwhelming. Here is how you can narrow down your selection.

Table of Contents

ToggleWatch out For Its Mobility and Adaptability

Small businesses often require the flexibility to accept payments anywhere. Opting for a portable card machine with wireless connectivity options like Bluetooth or 4G ensures you can accept payments on the go, meeting customer demands efficiently. Most countries nowadays have the 4G option, which means easy accessibility no matter where you may be.

Cost-Effectiveness

Keeping costs low is a priority for small businesses, as there isn’t a lot of money that can be spent or invested elsewhere. When selecting a card machine, consider upfront costs, transaction fees, monthly charges, and contract terms.

When doing all of the above, choose a provider with transparent pricing that aligns with your business’s transaction volume and budget constraints. Do a bit of research until you find your perfect solution.

Payment Diversity

Providing customers with multiple payment options enhances convenience and satisfaction. The more, the merrier rule does apply here! So, look for card machines that support contactless payments, mobile wallets, and alternative methods like QR codes.

Wondering if Sonic takes Apple Pay? With the plethora of options available today, it’s worth checking whether your favorite spots align with your preferred payment methods.

Nowadays there’s a plethora of options that one can go for and explore. Offering diverse payment options can attract more customers and boost revenue, no matter where you may be.

Integration and Insight

Seamless integration with other business tools such as POS systems and analytics software is essential. How often do you look at your insights, and do a bit of digging on what your company or your business may acquire? Choose a card machine provider that offers robust analytics tools to track sales trends and streamline operations for the best results.

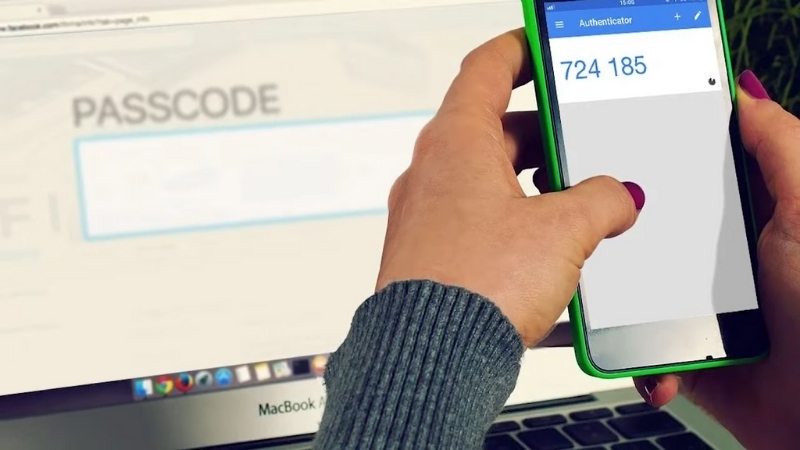

Security Measures

Protecting customer data is paramount. Ensure the card machine complies with industry standards like PCI DSS and offers advanced security features such as encryption and fraud detection.

Additionally, prioritize providers with reliable customer support to address security concerns promptly. No one wants to go for a card machine or payment option that they don’t know of, or who they can’t trust.

Scalability

Consider future growth and scalability when choosing a card machine. Select a provider that can accommodate your business’s expansion without disruptions or costly upgrades, since these will take way too much of your time.

Top 3 Best Card Machines for Small Businesses

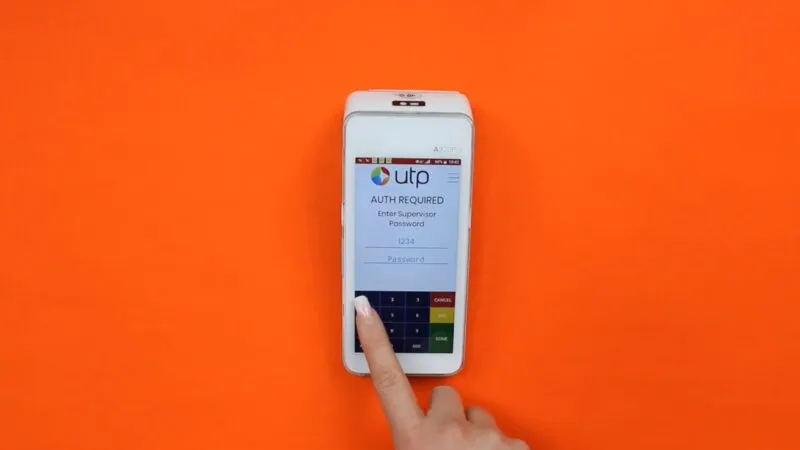

1. UTP

If you’re not too sure where to go and what to look for you should check out UTPGroup. It works with Barclaycard so you can sell with confidence and trust, worry-free. They have free services such as faster processing and a UTP shield, which will allow you to sleep soundly at night.

You can get the fastest payments in the UK for free while enjoying its use on all of your eCommerce products. Not only that, but they also have the highest level of anti-fraud protection. The business was founded on a desire to give clients the best experience both in terms of customer journey and technology provided, check them out and see for yourself.

2. Zettle

Zettle presents itself as a practical choice for merchants, boasting a variety of benefits. With its cost-effectiveness and integrated tools for sales forecasting and inventory management, it stands out as being a popular mobile merchant account option for small businesses.

While its affordability is a major advantage, it’s worth noting the relatively high 1.75% transaction fee. However, what it does lack is a virtual terminal service. If you want to try out something different quickly and you’re not a super picky person in general, you may enjoy Zettle.

3. Verifone

You have probably heard that the Verifone V200c is an excellent choice for small businesses. It is known for venturing into card payment acceptance, all while keeping costs in check. It has a nice memory capacity and can work with WiFi, Bluetooth, Ethernet, and dial-up.

However, what it does not have is the best pricing options + it is not designed for mobile use. You will like it since it accepts a wide range of payment options and types, and it can be used by different businesses, depending on their budget options.

FAQ

How Hard Is It and How Can One Obtain a Card Machine?

Do you want to start your business? Well, you can buy a credit card machine directly from the supplier, or you can rent one through an agreement with a merchant account provider. Do what suits you best and what is more within your interests.

Is a Business Account Necessary for A Card Machine?

While you don’t necessarily need a business account, you do require a merchant account service. You must have proper transactions and payouts sorted out.

Is It Possible to Acquire a Small Business Card Machine without A Contract?

There are some options that you can check out in this case, so yes, you can.

Having Said All of That

So, are you ready to scale your businesses to new levels and highs?

In summary, selecting the right card machine involves evaluating factors like mobility, cost-effectiveness, payment diversity, integration, and security. Just watch out before you consider your business’s needs and do the research on different providers.

Follow our guide, read the reviews, and check out a solution that works best for you, your budget, and your company while knowing you’re in safe hands.