Available payment options represent a very important factor for any business today. When you miss implementing a certain processor, that might lead to fewer customers.

The best way is to check out the recent trends. The choice will affect the fees, and how easy it is for the buyer to complete the whole process on your platform.

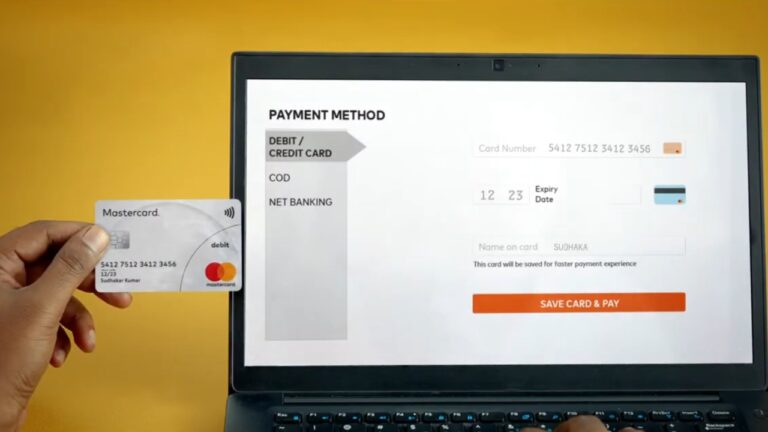

A great solution is to implement a system that will provide a higher flexibility. For example, the ability to pay with a credit card, e-wallet, and crypto. This feature is available on Noda.

Now I will write more about the benefits of popular online payment processors, along with potential downsides, and how to choose the right one.

Let’s Start with Benefits

Online payment platforms provide numerous advantages to both merchants and consumers. Fundamentally, they enable expedited transaction processing through digital interfaces. By streamlining financial exchanges, purchases can be finalized with impressive swiftness. This accelerated settlement benefits all parties through optimized efficiency and fluid commerce.

With internet connectivity nearly ubiquitous, online payment options facilitate shopping anytime, anywhere. This empowers customers to transact according to their own schedules through a diversity of channels. For businesses, the broader exposure amplifies market reach and taps an evolving consumer base that expects omnichannel availability.

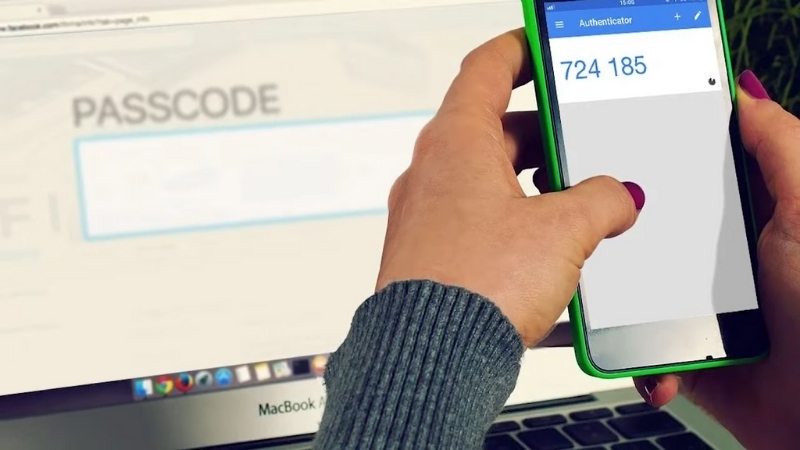

Naturally, security is a crucial concern that is ensured by these solutions. Leading providers safeguard sensitive financial data using robust encryption, authentication protocols, and sophisticated fraud detection.

This engenders confidence for all users that transactions and private information remain protected from malicious threats or unauthorized access. In an era of heightened cyber risks, prioritizing security is essential.

The shopping experience is also enhanced through intuitive interfaces and rapid transaction confirmation. Online payments streamline the purchase process, tending to heighten customer satisfaction levels. Higher satisfaction often translates to increased loyalty, advocacy, and repeat commerce over the long term – all of which are of great importance to merchants.

Furthermore, supporting innovative payment methods like cryptocurrency helps ensure long-term viability by accommodating changing consumer behaviors and preferences. As the adoption of emerging technologies grows, flexibility to accept preferred payment rails maintains relevance while retaining adaptable customers.

What About the Downsides?

One of the biggest things to watch out for is fees. A lot of payment processors will charge you each time someone buys something, plus you usually have to pay a monthly cost just to keep your account open.

All those fees really add up, especially if you’re just starting out and don’t have a ton of sales yet. It can really eat into the money you’re trying to make.

Security is another big concern even though sites work hard to protect you. Hackers are super smart these days and find new ways around protections all the time.

While encryption and fraud detection help, there’s always a chance someone could break through and steal customer information or money. If a breach happens, it causes major problems.

People might not want to shop with you anymore since you couldn’t keep them safe. You could also get in legal trouble or have to pay fees for dealing with the mess.

Technical problems could also cause trouble. What if the payment processing site goes down or your internet cuts out right when someone tries to buy something? Their payment won’t go through and they’ll probably get frustrated and go somewhere else instead.

That means lost sales that could have been yours. Little glitches and errors can also happen during transactions, making purchases fail. Both those scenarios hurt your business.

Relying on an internet connection is risky too. If a big storm knocks out the whole town’s wifi or your internet company has an outage, you won’t be able to accept any payments at all until service is back up. Again, that equals missed opportunities. It’s an even bigger problem if you’re in an area that doesn’t always have the fastest, most reliable internet access.

How to Choose the Right Combination?

When choosing an online payment solution, there are many important factors to consider to ensure the best fit for your business needs. Let me share a few key things to think about as you evaluate your options.

Assess Business Needs

There are many factors to consider when evaluating your specific requirements. A key starting point is understanding your typical transaction volume and values.

For example, if you primarily process hundreds of low-cost purchases daily, a payment provider designed for high volumes may be best. However, if your sales involve fewer but higher-priced transactions, look for options with more favorable rates in that range.

It’s also important to research the geographic locations of your customers. If you have an international buyer base, ensure the solution supports relevant foreign payment methods and currencies to give them easy checkout options. Consider also whether integrated features for VAT tax calculation or multi-lingual capabilities would benefit your business model.

Compare Fees and Costs

Costs are understandably a major concern, but it’s best not to make decisions based solely on price. Thoroughly examine associated transactions, monthly/annual, and setup fees to estimate true expenses.

However, also factors in the value of additional services. Sometimes a pricier provider may offer robust security, advanced analytics, or superior customer support worth paying for in return.

Evaluate Security Measures

Prioritizing security should be non-negotiable given the sensitive financial data involved. Strong measures like PCI compliance certification, SSL encryption for all pages, and sophisticated fraud detection tools provide baseline protections expected nowadays.

Look for a provider with a proven track record of guarding customer information and quickly addressing any issues that arise. The right solution bolsters trust between buyers and sellers.

Consider Customer Preferences

You can’t please all people, but offering payment options your target audience already uses results in frictionless transactions. Research which methods like credit cards, digital wallets, or ACH transfers are most widely adopted in your industry and geographical regions.

Catering to preferences streamlines checkout for higher conversion rates. Multichannel support also future-proofs your business as trends change over time.

Test for Integration and Compatibility

Before committing, do thorough due diligence by testing the solution yourself. Ensure smooth integration with your website, point-of-sale systems, accounting software, and any other platforms you rely on.

Compatibility issues can disrupt workflows and undermine a seamless customer experience. They may also require costly third-party developers to remedy problems down the line. Avoid future headaches by validating operational functionality upfront.

The Bottom Line

There are definitely benefits to consider, like faster payments speeding up the whole sales process. Strong security also gives customers peace of mind when they shop with you. And offering preferred payment methods makes checkout a breeze for people.

But you also gotta look out for potential downsides. Transaction fees cutting into profits is no fun, and technical glitches can damage your reputation if they cause issues for customers.

At the end of the day, the goal is to serve your customers as easily as possible so they want to keep coming back. Finding a payment solution that’s a great fit specifically for your business and audience is key to that.

Related Posts:

- Why Choosing a Chauffeured Car Service in Melbourne…

- What Are the Most Popular Sports in The World in 2024?

- Is Buying a Used Phone Safe in 2025? Check Out the…

- Unlocking Lebron’s Recovery Secrets: 8 Tips to Take…

- How Early Should You Get to the Airport? 7 Tips for…

- Don’t Fall for AI Scams - 7 Tips to Identify AI-…