In 2025, compliance with Know Your Customer (KYC) laws is no longer optional for businesses operating in the United States. KYC rules, part of a broader anti-money laundering (AML) and counter-terrorist financing (CTF) framework, require companies to verify the identity of clients, monitor transactions, and flag suspicious activity.

Originally applied primarily to banks and financial institutions, KYC obligations now extend to fintech firms, cryptocurrency exchanges, payment processors, investment advisors, and even certain non-financial businesses.

The stakes are high. Failure to comply can result in heavy penalties, reputational damage, and, in some cases, criminal liability. In 2024 alone, U.S. regulators issued over $4.6 billion in fines globally for AML and KYC violations, underscoring how aggressively enforcement has escalated.

Know Your Customer (KYC) refers to the set of regulations and practices businesses must follow to verify a customer’s identity before and during business relationships. The goal is to prevent illegal activities such as:

KYC is not a single law but a collection of requirements drawn from statutes like the Bank Secrecy Act (1970), the USA PATRIOT Act (2001), and more recent updates through the Anti-Money Laundering Act of 2020 and FinCEN’s 2024–2025 compliance guidance.

Table of Contents

ToggleCore KYC Requirements in 2025

Businesses subject to KYC obligations must implement processes that cover four main areas:

Requirement

Description

Example in Practice

Customer Identification Program (CIP)

Collect and verify identity information before onboarding

A crypto exchange verifying a driver’s license + proof of address

Customer Due Diligence (CDD)

Assess the risk level of each customer, monitor for red flags

Classifying g clients as low, medium, or high risk

Enhanced Due Diligence (EDD)

Extr the checks for high-risk customers or politically exposed persons (PEPs)

Running background checks on overseas investors

Ongoing Monitoring

Continuous tracking of customer activity to detect unusual behavior

A bank flagging large wire transfers as inconsistent with prior activity

6 Key Updates for 2025

KYC compliance in the United States has become more complex in 2025, as regulators introduce new requirements and refine existing standards. Businesses must now adapt to several important developments:

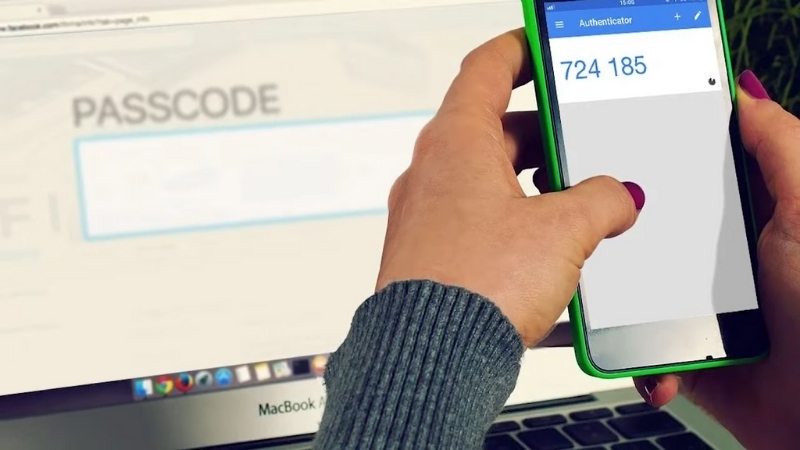

1. Digital Identity Integration

Regulators have formally recognized the use of digital identity frameworks for customer verification. This makes onboarding faster and more efficient, especially for businesses with remote clients, but it also comes with stricter cybersecurity obligations.

Companies are now expected to protect sensitive identity data with advanced safeguards to prevent breaches or misuse.

2. Beneficial Ownership Registry

The Corporate Transparency Act, which came into effect in January 2024, requires many companies to disclose their beneficial ownership details to FinCEN.

This reporting obligation now forms a central part of KYC, as financial institutions are required to cross-check this registry when assessing customer risk and verifying corporate clients.

3. Crypto and Fintech Oversight

Virtual asset service providers, including cryptocurrency exchanges and wallet providers, face stricter KYC standards.

In addition to verifying customer identity, they must also conduct blockchain transaction monitoring to flag suspicious activity across decentralized networks. This marks one of the biggest regulatory shifts for digital finance.

4. AI-Driven Monitoring Expectations

Larger institutions are now expected to integrate artificial intelligence and automated systems into their compliance programs.

These technologies can detect anomalies and suspicious transactions in real time, reducing human error and meeting regulators’ growing demands for proactive monitoring.

5. Cross-Border Alignment

FATF’s updated guidance promotes inclusion through risk-based and proportionate AML/CFT measures. 💡

🎥Hear from experts in our new video and see what is new: https://t.co/uGbN8WUbkC pic.twitter.com/8toT8FYNHl

— FATF (@FATFNews) July 1, 2025

The U.S. has moved closer to global AML and KYC standards, aligning with frameworks set by the European Union and the Financial Action Task Force (FATF).

This harmonization is designed to make compliance more uniform for businesses that operate internationally, while also tightening global defenses against money laundering and terrorism financing.

6. High-Risk Industries Like Online Gambling

Regulators are paying closer attention to industries that have historically been used for money laundering, including online casinos and gaming platforms. KYC requirements for these businesses are becoming stricter, especially around verifying customer identity and monitoring high-value transactions.

Resources such as onlineunitedstatescasinos.org highlight how operators are adapting to the latest compliance demands, balancing user experience with security and regulatory obligations.

Who Needs to Comply?

While banks remain the most visible entities under KYC, the scope now extends much further.

Sector

KYC Obligation

Banks & Credit Unions

Full CIP, CDD, EDD, and ongoing monitoring

Brokerages & Investment Advisors

Verify all account holders, monitor transactions

Payment Processors & Fintechs

Digital onboarding checks, fraud monitoring

Crypto Exchanges & Wallet Providers

Full KYC + blockchain transaction analysis

Insurance & Real Estate Firms

Identify beneficial owners in large transactions

Legal & Accounting Firms (Certain Transactions)

Must report when handling high-value payments

If your business touches finance in any way, KYC is likely part of your compliance framework.

Penalties for Non-Compliance

The consequences for ignoring KYC obligations are severe:

- Financial Penalties: Fines can range from thousands to millions per violation. For example, U.S. regulators fined a European bank $390 million in 2023 for KYC failures.

- Reputational Damage: Publicized violations erode customer trust and investor confidence.

- Operational Restrictions: Regulators can suspend licenses or block mergers.

- Criminal Liability: In extreme cases, executives face personal liability, including prison time.

5 Best Practices for Businesses in 2025

To stay compliant, businesses should adopt a structured, proactive approach:

Looking Ahead – The Future of KYC

As financial crimes grow more complex, KYC laws will continue to evolve. Expect further emphasis on real-time monitoring, stronger cybersecurity standards, and expanded cross-border cooperation.

For U.S. businesses, compliance is no longer just a legal requirement; it is also a competitive advantage. Firms with strong KYC processes build trust with customers, avoid costly penalties, and position themselves for global growth.

Conclusion

The Know Your Customer (KYC) law in the U.S. has expanded dramatically in scope by 2025. What once applied only to banks now touches fintech startups, crypto platforms, real estate firms, and even professional service providers handling large payments.

For businesses, the challenge is to keep up with regulatory expectations while maintaining efficient operations.

Those that invest in digital tools, staff training, and risk-based monitoring will not only remain compliant but also strengthen their reputation in an increasingly competitive and scrutinized market.